Reverse mortgage purchase down payment calculator

If you are purchasing raw land the preferred down payment can be as much as 30 to 50 of the total cost. A Reverse Mortgage is the opposite you accumulate the loan over time and pay it all back when you and your spouse if applicable are no longer living in the home or.

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

This is how much itll cost you over time to borrow this amount of moneyIn other words this is how much the lender will charge as payment for giving you the mortgage.

. Larger Down Payments Land loans typically require a larger down payment than traditional mortgages often as much as 20 to 30 of the asking price. Why A Reverse Sales Tax Calculator is Useful. The value of his current home is 400000.

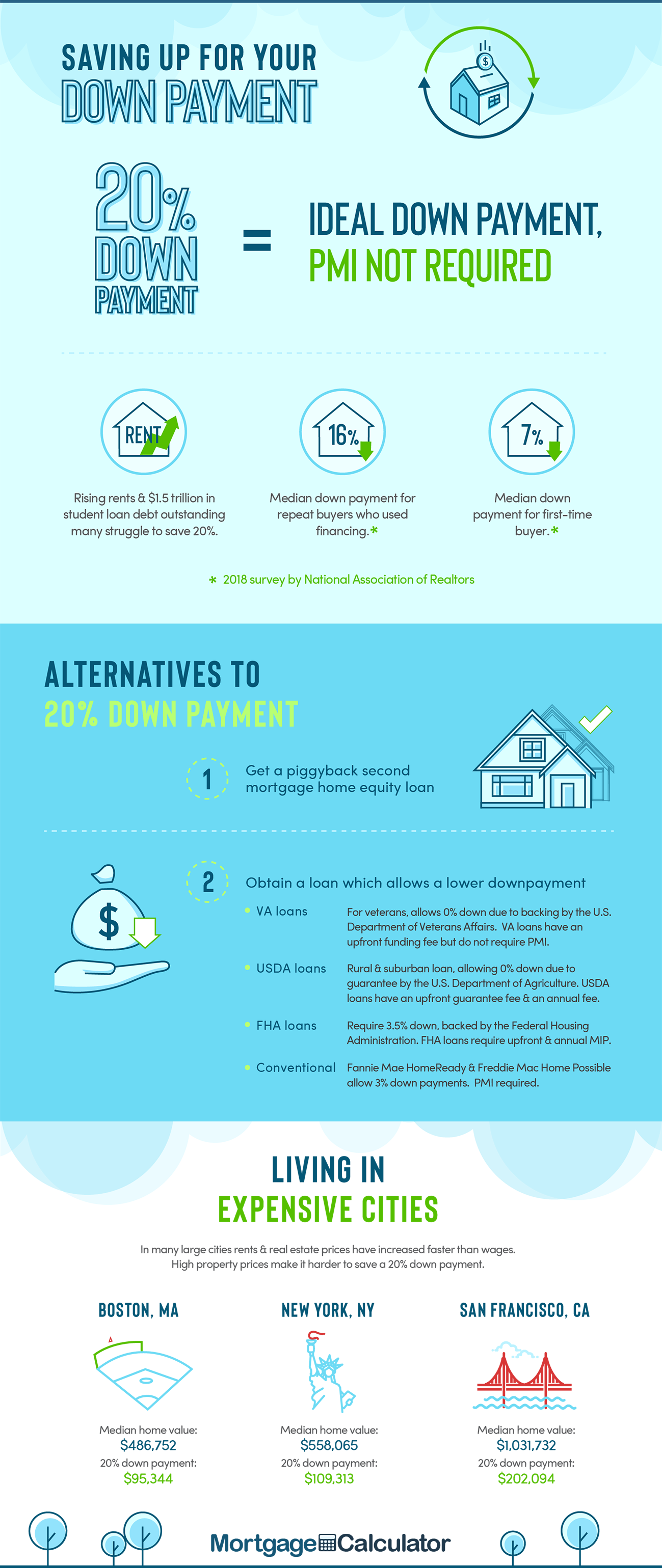

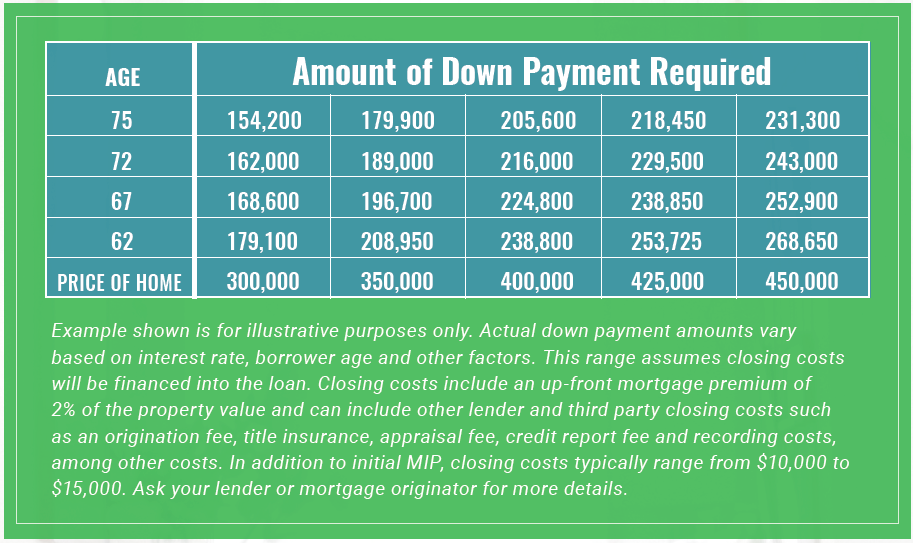

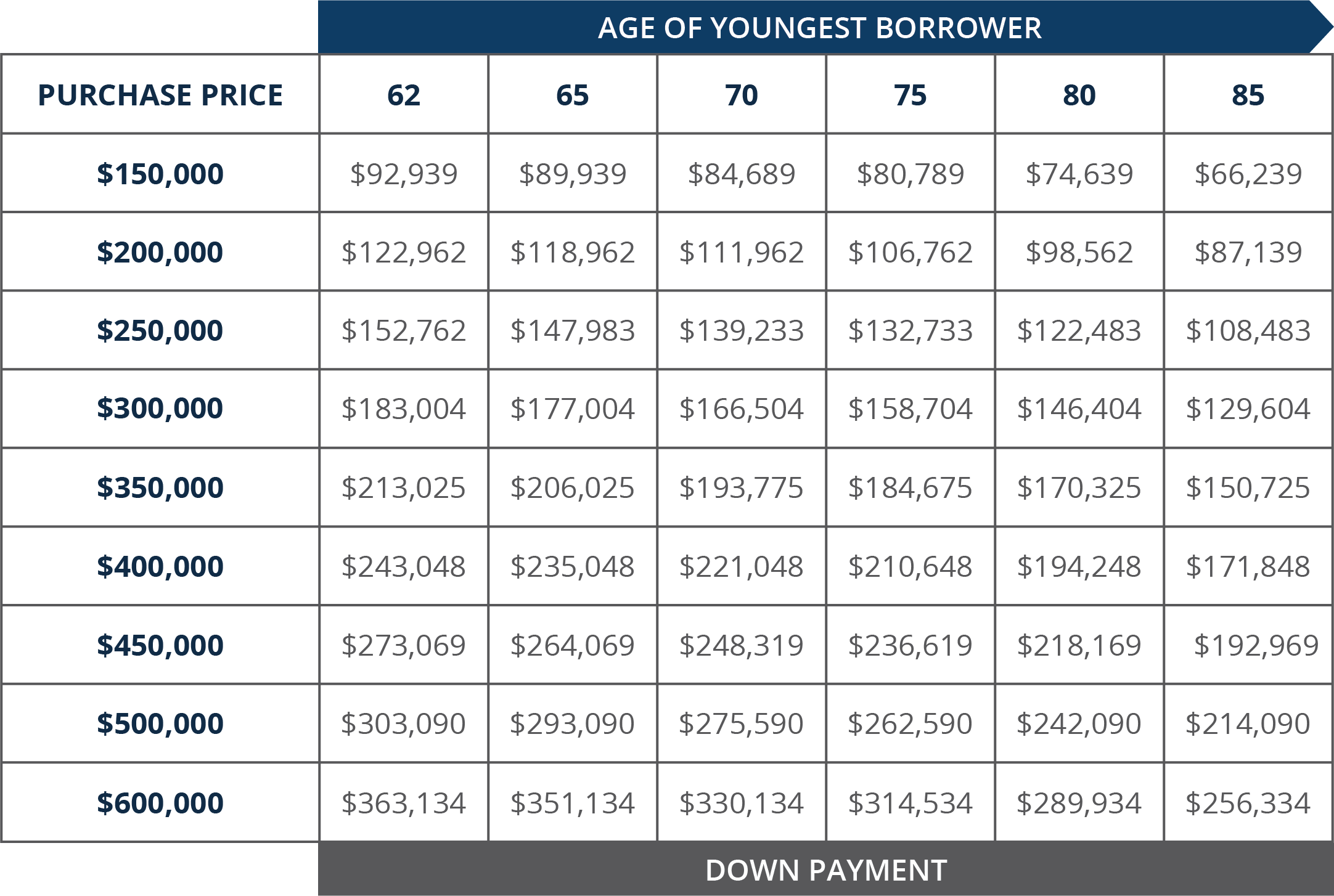

For down payments of less than 20 home buyers are required to purchase mortgage default insurance commonly referred to as CMHC insurance. With a traditional mortgage you borrow money up front and pay the loan down over time. Any borrower on a reverse mortgage must be at least 62 years old.

Shop Using the Kosher Reverse Mortgage Calculator. The minimum down payment in Canada is 5. Mortgage Balance on Title.

You must look at your expected returns. Wells Fargo offers several low down payment options including conventional loans those not backed by a government agency. They claim that it is quite difficult to come up with the money.

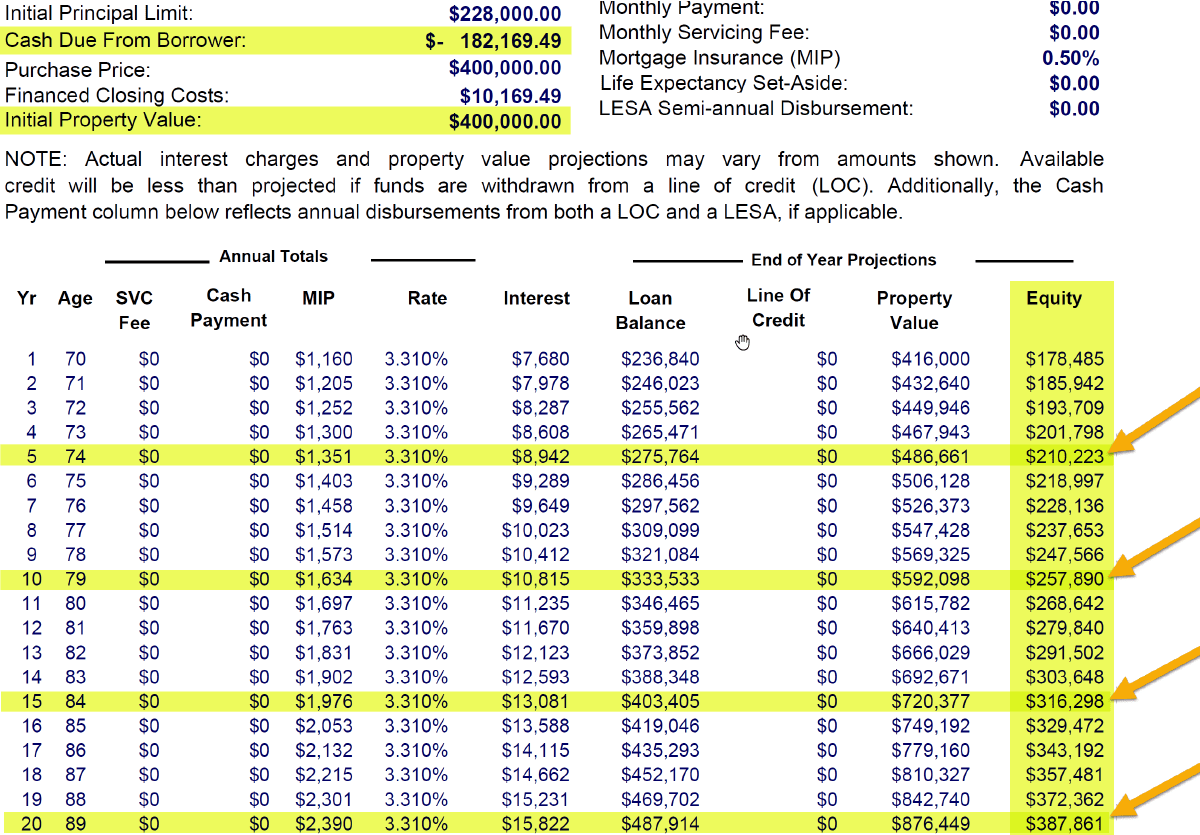

Like fixed-rate HECMs HECMs for purchase only offer lump-sum payments as the cash will only be needed for a single immediate purpose. A reverse mortgage works by allowing homeowners age 62 and older to borrow from their homes equity without having to make monthly mortgage payments. The only thing to remember in our Reverse Sales Tax Calculator is that the top input box is for the sales tax percentage and the bottom input box is for the total purchase price.

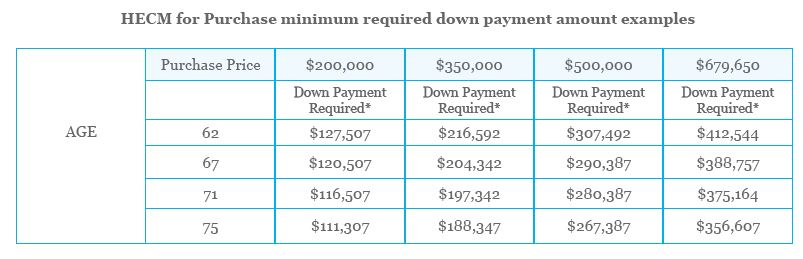

The purchase price of his next home is also 300000. The reverse mortgage borrower pays the remainder as a down payment using part of the proceeds from the sale of their previous home. Ask a Reverse Mortgage Expert.

Estimated Home Value or Purchase value. Texas was the last state to allow for reverse mortgages for purchase. Conventional fixed-rate loans are available with a down payment as low as 3.

A Reverse Mortgage is a mortgage in reverse that can be hard to get your head around. Don may use the proceeds from a HECM for Purchase Loan of 168600 3 and a cash investment of 146140 to purchase his next home eliminate monthly mortgage payments 1 and move closer to. Under Scenario B the additional 15000 put towards the mortgage down payment lowers CMHC insurance by 2423 and saves the homebuyer around 25000 in interest over the life of the mortgage.

Get an Instant Quote by ARLO. The company also offers a solid array of online resources including a reverse mortgage blog an FAQ section and a reverse mortgage calculator and on the interest rate front Fairways rates fall somewhere in the middle. Learn How the Kosher Reverse HECM Mortage is Different.

If youre married and your spouse isnt yet 62 getting a reverse mortgage is not ideal. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and. However he wants to eliminate his monthly mortgage payments.

Read Articles on Reverse Mortgages. Proceeds to Client---Does Not include Closing Costs. Down payment The amount of money you pay up front to obtain a mortgage.

Most payment options include a deposit amount if the purchase if not made at once. However it is also important to consider the opportunity cost or alternative uses for the additional outlay under Scenario B. Though new laws may protect your non.

A reverse mortgage is a mortgage loan. A reverse mortgage is unlike a traditional mortgage in that you can defer payment of your loan balance principal interest and FHA mortgage insurance premium until you sell or move out of the home or pass away. View the Current State of the Reverse Mortgage Market.

If your client has positive proceeds please complete the pre-qual by clicking here. The most common type of reverse mortgage is the Home Equity Conversion Mortgage a program insured by the Federal Housing Administration since 1988The amount. Down payment 1 Down payment 2 Down payment 3 Down payment 4 minus.

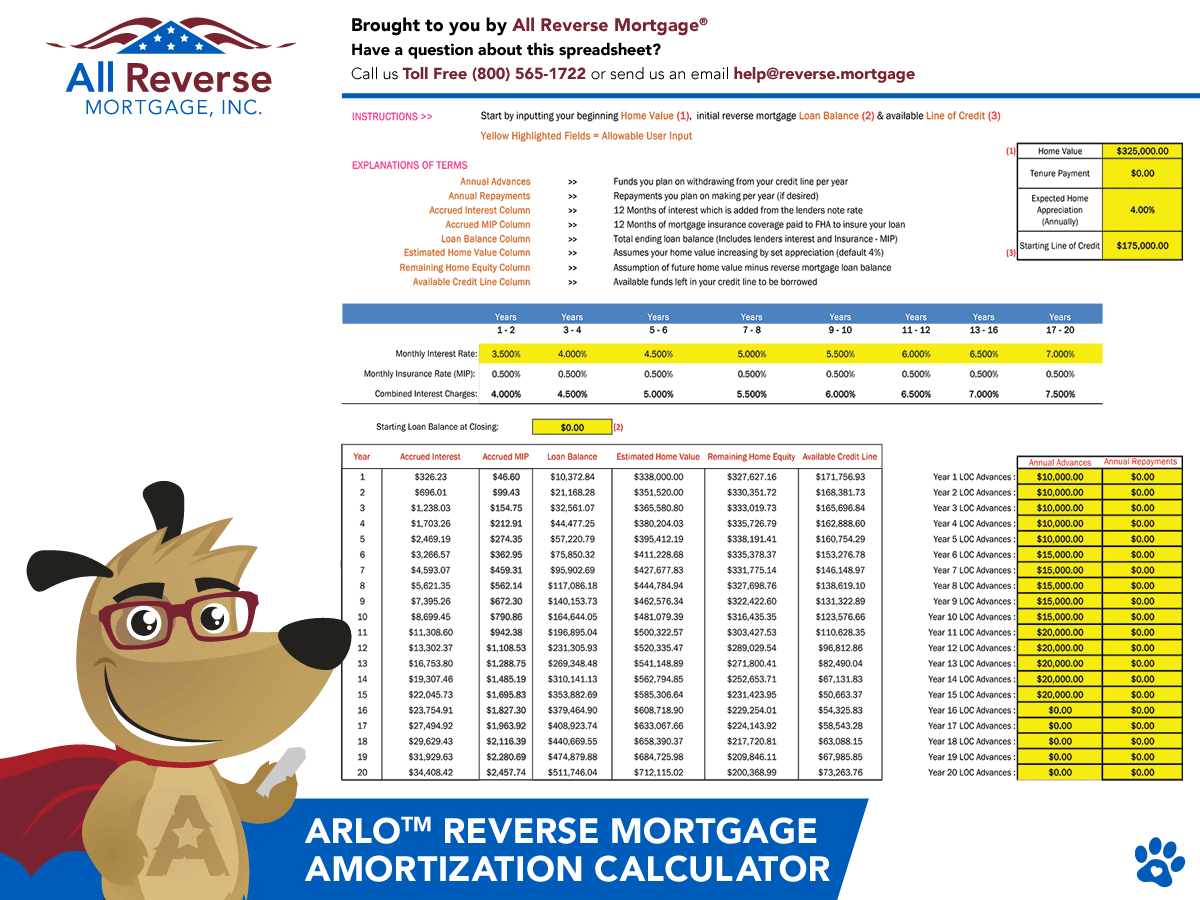

Download a Spreadsheet to Assess Whether a HECM Should be Modified or Refinanced. Americas 1 rated reverse mortgage lender. Keep in mind that with a low down payment mortgage insurance will be required which increases the cost of the loan and will increase your monthly payment.

This is the total amount youre financing including the purchase price of the home minus any down payment and sometimes closing costs or other fees. This opinion stems from the inclusion of the FHA Upfront Mortgage insurance which protects the BORROWER and confusion regarding. It Seems Complicated.

Recent Reverse Mortgage Rates and Fees. Approximate Down Payment---Purchase Transactions Calculate Values. Age of the Youngest Borrower.

In such a case the buyer considers their current location which is often too expensive. Once the reverse mortgaged home is sold as is the case with our two other HECM options. 35 of prospective home owners are intimidated by the deposit amounts for a property.

Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals. Your instant quote includes eligibility. Closing costs Reverse mortgages are frequently criticized over the issue of closing costs which can sometimes be expensive.

According to an analysis of HECMs issued March 2021 to March 2022 theyre not the lowest of the lenders on our list but theyre certainly not. However you must continue to maintain your home pay property taxes and homeowners insurance and comply with your loan terms. Compare Real-Time Rates Custom Amortization Calculations.

How does a reverse mortgage work.

Hecm For Purchase Reverse Mortgage Funding Llc Rmf

Hecm For Purchase Reverse Mortgage

Free Reverse Mortgage Amortization Calculator Excel File

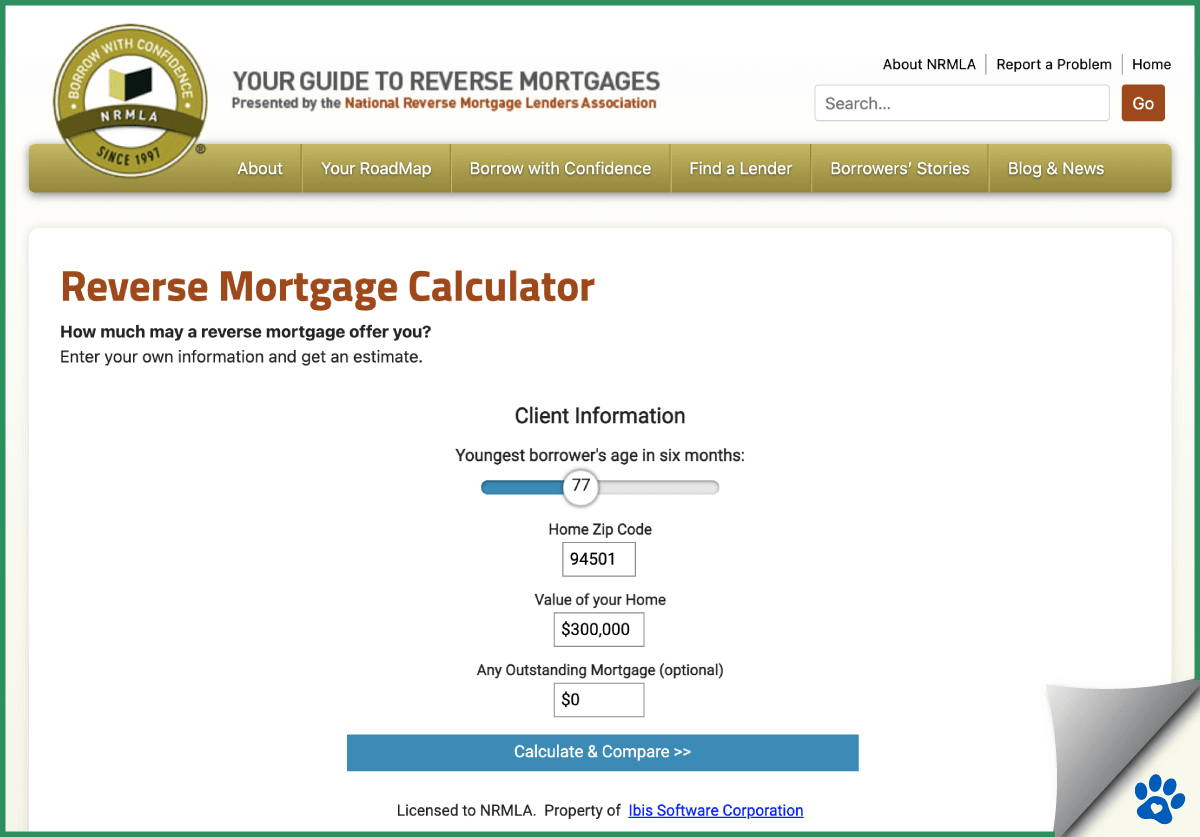

Reverse Mortgage Calculator

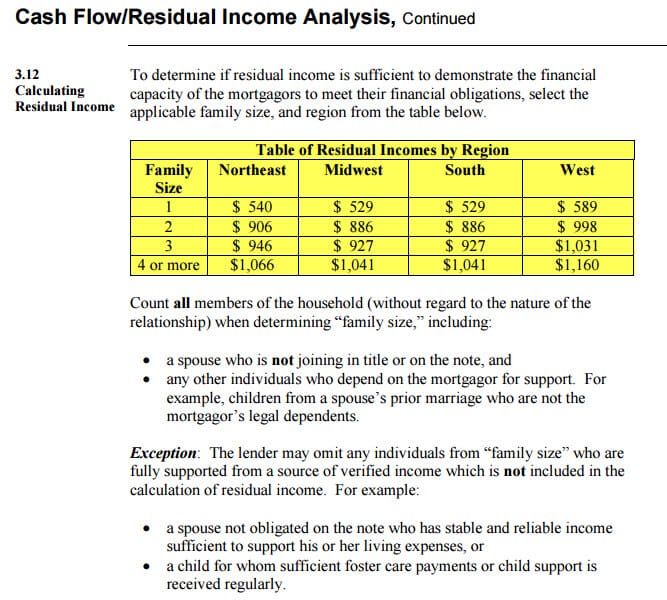

Here Are The Income Requirements For A Reverse Mortgage

Home Loan Downpayment Calculator

Free Financial Family Home Safety Advice For Homeowners

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

Lyyxjvxuejrpam

Hecm For Purchase Buy Your Next Home Without A Mortgage Payment

Reverse Mortgage For Purchase H4p Northwest Reverse Mortgage

Free Reverse Mortgage Calculator No Personal Information Reversemortgagereviews Org

Using A Hecm Reverse Mortgage To Prevent Future Impoverishment

Reverse Mortgage For Purchase Access Reverse Mortgage

Reverse Mortgage Calculator How Does It Work And Examples

Reverse Mortgage Purchase Down Payment Rates Eligibility

Open Mortgage