Estimate my tax return 2021

10 of the taxable income. To change your tax withholding amount.

Help In Preparing For 2021 Tax Season Financial Analysis Taxes Humor Bank Jobs

For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with.

. Use your estimate to change your tax withholding amount on Form W-4. Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps. Then income tax equals.

Wondering how to estimate your 2021 tax refund. 2021 Returns can no longer be e-filed as of October 17 2022. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

100 Free Tax Filing. Use our Tax Bracket Calculator to answer what tax bracket am I in for your. Then income tax equals.

Just answer a few simple questions about. 99500 plus 12 of the excess over 9950. Efile your tax return directly to the IRS.

After You Use the Estimator. Residents could also qualify for an additional property tax refund of up to 300. Free And Easy Tax Estimator Tool For Any Tax Form.

For recent developments see the tax year 2021 Publication 505 Tax Withholding and. Over 9950 but not over 40525. How We Calculate the Penalty.

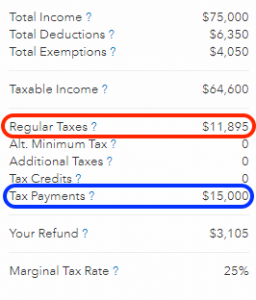

55 58 votes. It is mainly intended for residents of the US. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Those are not sent to the. Prepare federal and state income taxes online. Locate the amount on line 65 line 66 for the noncustodial parent earned income credit of your 2021 return.

And is based on the tax brackets of 2021. 100 of the tax shown on your 2021 return. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc.

See how your refund take-home pay or tax due are affected by withholding amount. 2021 Tax Return Estimator Calculator. Start the TAXstimator Then select your IRS Tax Return Filing Status.

You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Beyond this date use the 2021 Tax Return Calculator below to estimate your return before filling in the forms online. 100 of the tax shown on your 2021 return.

State residents who have filed their 2021 return by June 30 will get a. Or keep the same amount. After 11302022 TurboTax Live Full Service customers will be able to amend their.

2021 tax preparation software. Tax Calculator for 2021 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions Other. If lines 65 and 66 are both blank you did not claim this credit and are not eligible.

We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on. Estimates were produced only because you owed more than 1000 on the 2021 return and are OPTIONAL to pay. The base amount for the 202122 income.

As announced in the 202223 federal Budget the low and middle income tax offset has been increased by 420 for the 202122 income year.

2020 2021 Tax Estimate Spreadsheet Income Tax Capital Gains Tax Tax Brackets

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

Do You Need To File A Tax Return In 2022 Forbes Advisor

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return Income Tax Return How To Find Out Business Tax

Pin On Starting A Business Side Hustles After Divorce

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Payers Get Your Free Estimate Today E File Today All Clients Receive Gift Card Air Fair Or Hotel Travel Opti Credit Repair Tax Refund College Credit

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

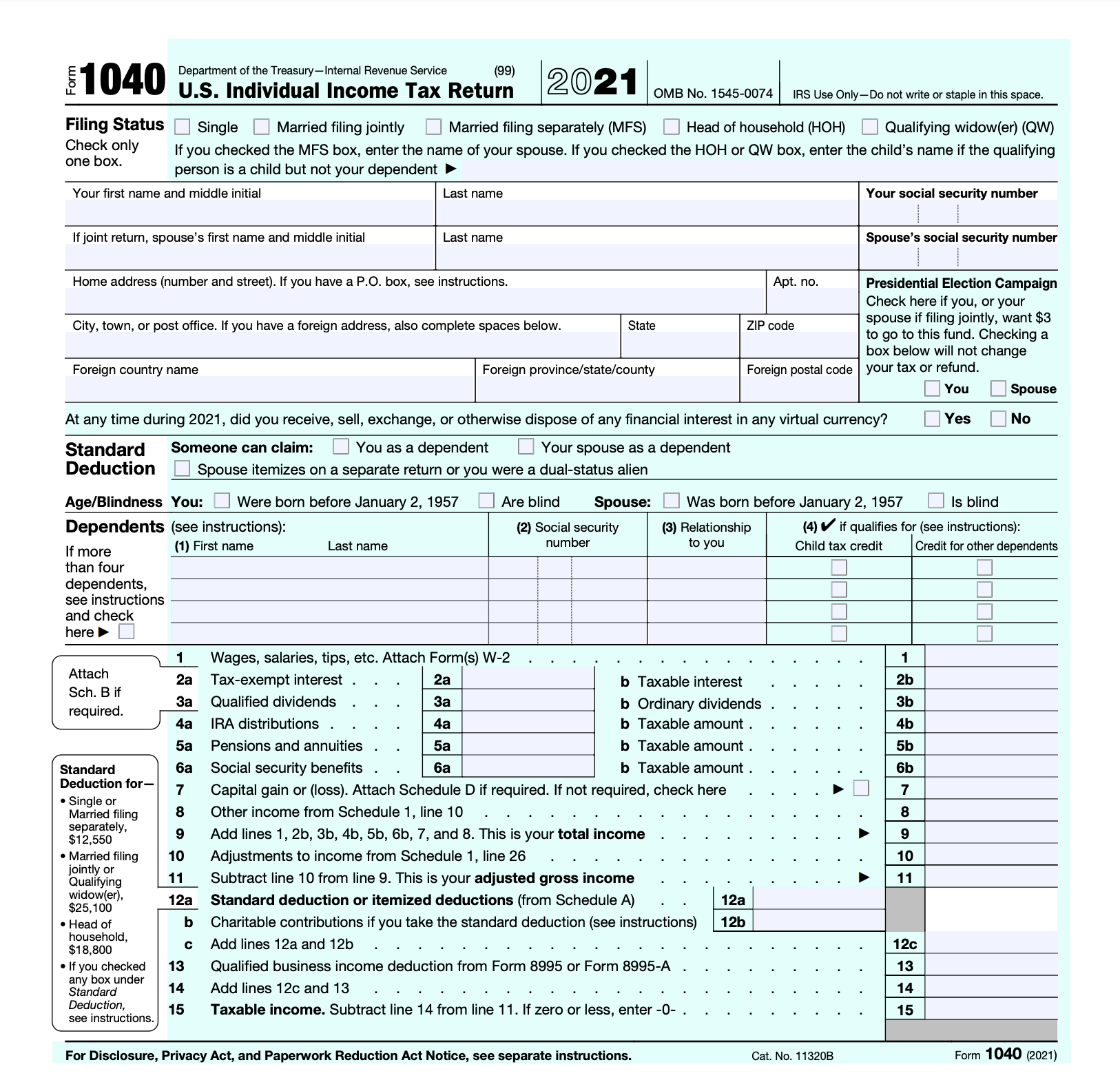

What Is A 1040 Form

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Turbotax Taxcaster Free Tax Calculator Free Tax Refund Estimator Tax Refund Turbotax Finance Apps

What Was Your Income Tax For 2019 Federal Student Aid

Pin On Hhh